17+ Amortization rate

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. I comment 17c1-10 creditors to compute a composite APR where initial rate on variable-rate transaction not determined by reference.

Amortization Schedule 10 Examples Format Sample Examples

7YR Adjustable Rate Mortgage Calculator.

. Almost any data field on this form may be calculated. Second mortgages come in two main forms home equity loans and home equity lines of credit. Amortization Formula in Excel With Excel Template Now let us see how amortization can be calculated by excel.

Calculate your interest payment. If the amortization period of a fixed-rate loan is longer than the term of the loan ie because the loan has a balloon feature- the lender should use the term when calculating the rate spread. Subtract your interest payment from your total monthly payment to see how much goes toward paying down your loan.

Free calculators for your every need. Find your monthly interest rate. Bonds Payable Issued at a Premium.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. 30-Year Mortgage Amortization Schedule by Month. Businesses depreciate long-term assets for both tax and accounting purposes.

A couple took an auto loan from a bank of 10000 at the rate of interest of 10 for the period of 2 years. You can also use the button at the bottom of the calculator to print out a printable loan amortization table. In this example its 31833 35166 3333.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. 17-Feb-2022 The type and rule above prints on all proofs including departmental reproduction proofs.

Your monthly interest rate Lenders provide you an annual rate so youll need to divide that figure by 12 the number of months in a year to get the monthly rate. The current best high-ratio fixed mortgage rate in Quebec is 424. Suppose for example a business issued 10 2-year bonds payable with a par value of 250000 and semi-annual payments in return for cash of 259075 representing a market rate of 8.

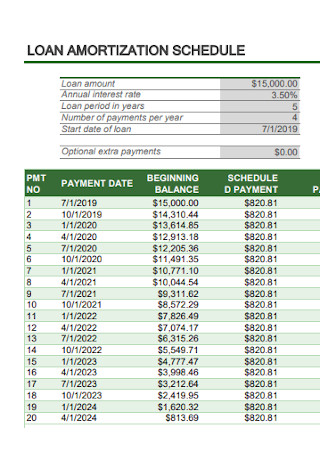

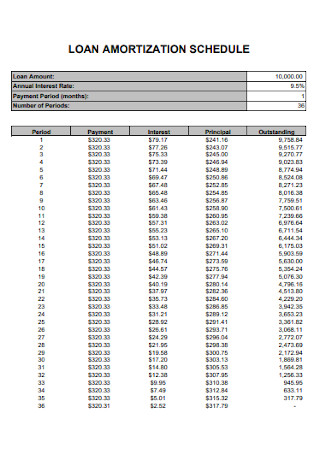

The company assumed a life of goodwill as 10 years. For tax purposes. In the Period column enter a series of numbers equal to the total number of payments 1- 24 in this example.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. The loan is secured on the borrowers property through a process. If anything the above tables understate the current dominance of the 30 year FRM.

As of August 18 2022 the average 5-year fixed mortgage rate available from the Big 5 Banks is 532. C2 - annual interest rate. C3 - loan term in years.

You can also use the button at the bottom of the calculator to print out a printable loan amortization table. It also refers to the spreading out. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future.

3YR Adjustable Rate Mortgage Calculator. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. The term of the loan is 360 months 30 years.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life. Your monthly payment is 59955.

To calculate amortization you will convert the annual interest rate into a monthly rate. Get 247 customer support help when you place a homework help service order with us. If anything the above tables understate the current dominance of the 30 year FRM.

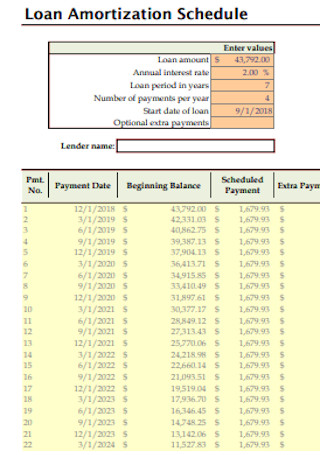

The next thing you do is to create an amortization table with the labels Period Payment Interest Principal Balance in A7E7. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. Now if we took the same example from above but stretched out your repayment plan to a 30-year mortgage your interest rate would probably bump up to 4 and your monthly payment would drop to 1146.

Since amortization is a monthly calculation in this example the term is stated in months not years. Amortization Expense for the Year Goodwill Value Life Amortization Expense 50000010. The MND Rate Index is the best way to follow day-to-day movement in mortgage rates.

Divide your interest rate by 12 to get your monthly interest rateIn this case its 0008333 01012. Your interest rate 6 is the annual rate on the loan. Rates from the Big 5.

For tax year 2021 the standard mileage rate for the cost of operating your car van pickup or panel truck for each. By making additional monthly payments you will be able to repay your loan much more quickly. Todays national mortgage rate trends.

Pass amortization entry as of 31122019. An example will help to make matters clearer. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules.

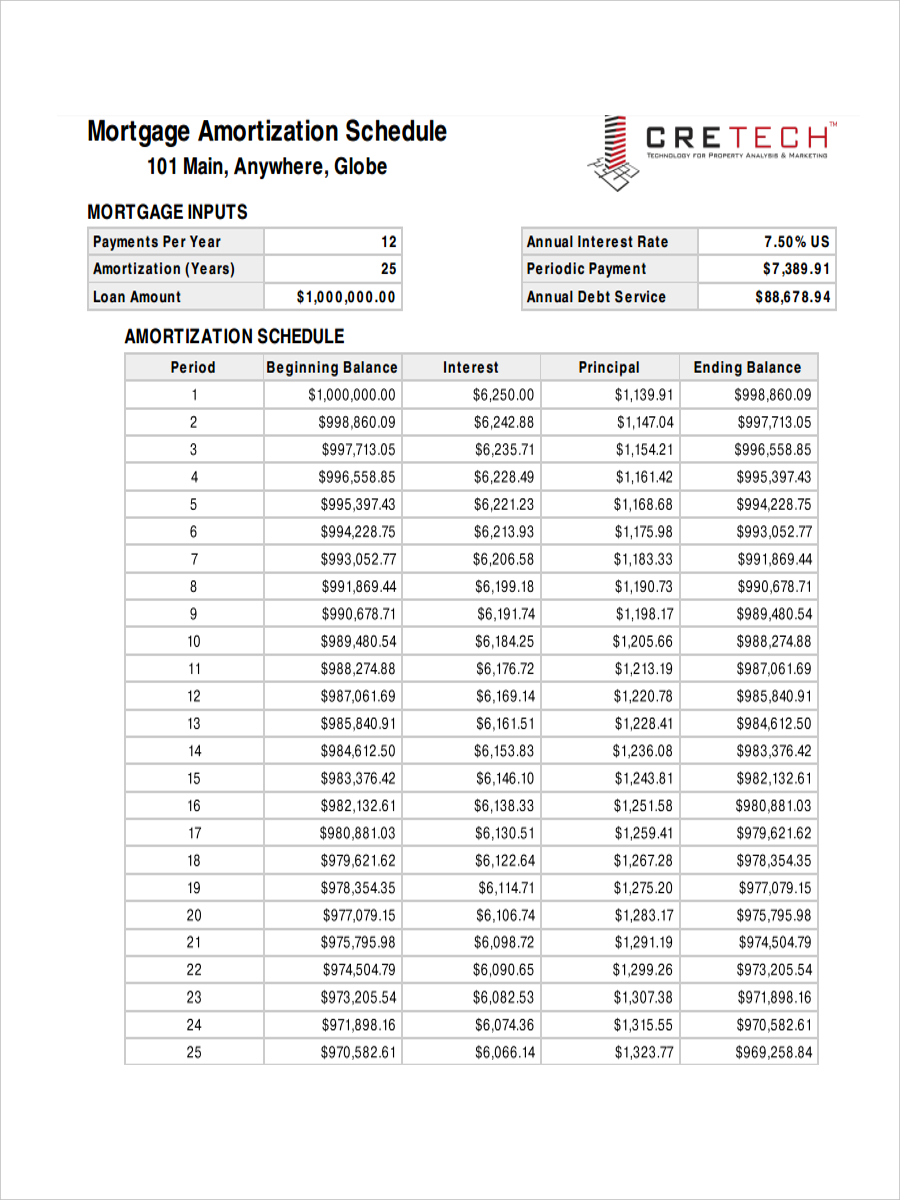

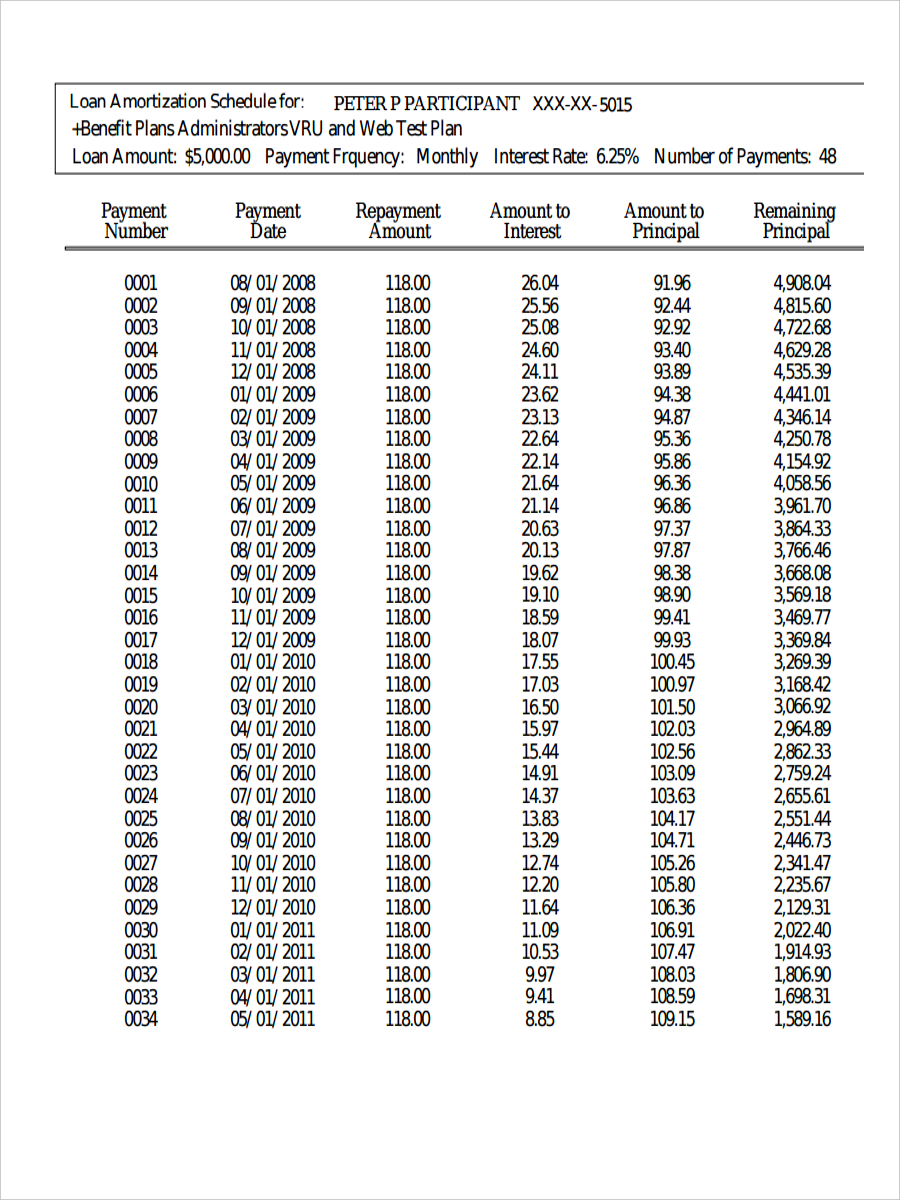

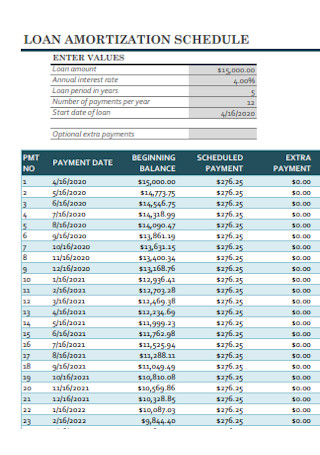

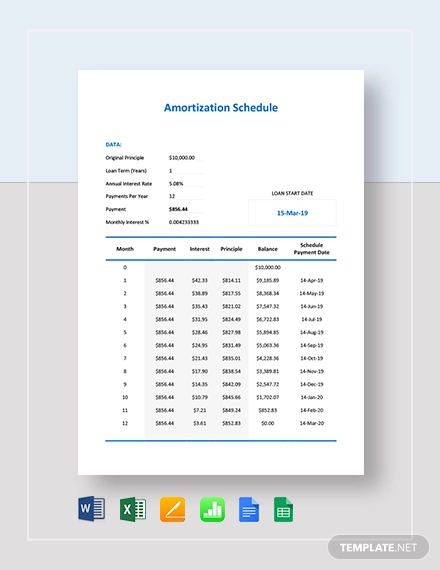

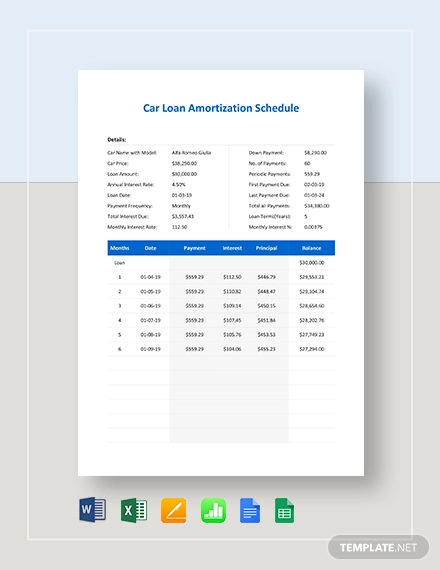

If your interest rate is 5. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. C4 - number of payments per year.

Business Bad Debts41 Chapter 11. Calculate loan payment payoff time balloon interest rate even negative amortizations. Unlike mortgage rate surveys our index is driven by real-time changes in actual lender rate sheets.

Amortization in excel is Calculated Using Below formula. Now we have to calculate EMI amount for the same. Amortization Expense for the Year is calculated as.

Second mortgage types Lump sum. Calculate your principal payment. C5 - loan amount.

This rate is available in Ontario Alberta and British Columbia. Brets mortgageloan amortization schedule calculator.

Tables To Calculate Loan Amortization Schedule Free Business Templates

Amortization Schedule 10 Examples Format Sample Examples

Amortization Schedule Example Amortization Calculator Things Prepared Before Buying A Home Preparationof Homebuying Amortization Calculator Amortization Schedule Mortgage Amortization Mortgage Amortization Calculator

8 Sample Loan Amortization Schedules In Pdf Ms Word

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

8 Sample Loan Amortization Schedules In Pdf Ms Word

Tables To Calculate Loan Amortization Schedule Free Business Templates

Amortization Schedule 10 Examples Format Sample Examples

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

8 Sample Loan Amortization Schedules In Pdf Ms Word

Amortization Schedule 10 Examples Format Sample Examples

Amortization Schedule 10 Examples Format Sample Examples

How Do Intangible Assets Show On A Balance Sheet

8 Sample Loan Amortization Schedules In Pdf Ms Word